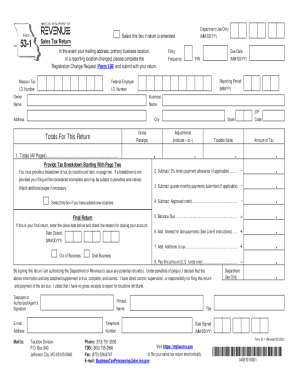

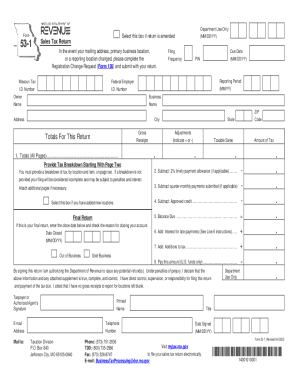

MO DOR-2760 2013-2026 free printable template

Show details

Have you considered e-filing? Visit our website at http://dor.mo.gov/business/payonline.php for more information. MISSOURI DEPARTMENT OF REVENUE PO BOX 3360, JEFFERSON CITY, MO 65105-3360 SALES TAX

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign missouri tax return form

Edit your missouri tax return online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mo dor printable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mo dept of revenue forms online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit missouri sales tax return form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO DOR-2760 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out missouri department of revenue forms

How to fill out MO DOR-2760

01

Obtain a blank MO DOR-2760 form from the Missouri Department of Revenue website or local office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Indicate the type of transaction or claim you are filing for.

04

Provide the details of your income, deductions, and any credits you are claiming.

05

Double-check the totals and ensure all necessary calculations are accurate.

06

Sign and date the form at the designated section.

07

Submit the completed form to the appropriate processing center based on the instructions provided.

Who needs MO DOR-2760?

01

Individuals or businesses that are applying for a tax refund, claiming credits, or reporting certain income in Missouri need to fill out the MO DOR-2760 form.

Fill

mo form 5633

: Try Risk Free

People Also Ask about missouri form 5633

What is the most tax friendly state?

MoneyGeek's analysis found that Wyoming is the most tax-friendly state in America, followed by Nevada, Tennessee, Florida and Alaska. States that received a grade of A all share something in common: no state income tax. Washington and South Dakota — which both received a B — also have no state income tax.

Which US state has the lowest taxes?

In 2020, the average American contributed 8.9% percent of their income in state taxes. Alaska had the lowest average overall tax burden – measured as total individual taxes paid divided by total personal income – at 5.4%, followed by Tennessee (6.3%), New Hampshire (6.4%), Wyoming (6.6%) and Florida (6.7%).

What is the sales tax in St Louis city?

The Missouri sales tax rate is currently 4.23%. The County sales tax rate is 0%. The Saint Louis sales tax rate is 5.45%.

What is the sales tax in Missouri 2023?

2023 List of Missouri Local Sales Tax Rates. Missouri has state sales tax of 4.225%, and allows local governments to collect a local option sales tax of up to 5.375%. There are a total of 754 local tax jurisdictions across the state, collecting an average local tax of 3.761%.

What states have no sales tax?

What states have no sales tax? There are five states with no general statewide sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon.

Does Missouri have sales tax on food?

Take-home grocery food items in Missouri are taxed by the state at a rate of 1.225%, which goes mainly to a fund for public schools. Localities levy additional grocery sales taxes at varying rates which can add up to 8%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tax filing missouri without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your mo sales tax form into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send 17920237 to be eSigned by others?

Once your missouri dept of revenue forms is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit missouri sales tax forms on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share mo sales tax return on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is MO DOR-2760?

MO DOR-2760 is a form used by the Missouri Department of Revenue to report and pay certain state taxes.

Who is required to file MO DOR-2760?

Businesses and individuals who have tax obligations to the state of Missouri need to file MO DOR-2760.

How to fill out MO DOR-2760?

To fill out MO DOR-2760, provide accurate business or personal information, report the appropriate tax amounts, and follow the instructions provided on the form.

What is the purpose of MO DOR-2760?

The purpose of MO DOR-2760 is to collect state taxes owed by individuals and businesses in Missouri, ensuring compliance with state tax laws.

What information must be reported on MO DOR-2760?

The form requires reporting of taxpayer identification, tax type, amount owed, and other relevant financial details.

Fill out your MO DOR-2760 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Of Missouri Tax Forms is not the form you're looking for?Search for another form here.

Keywords relevant to missouri sales tax return

Related to form 5633

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.